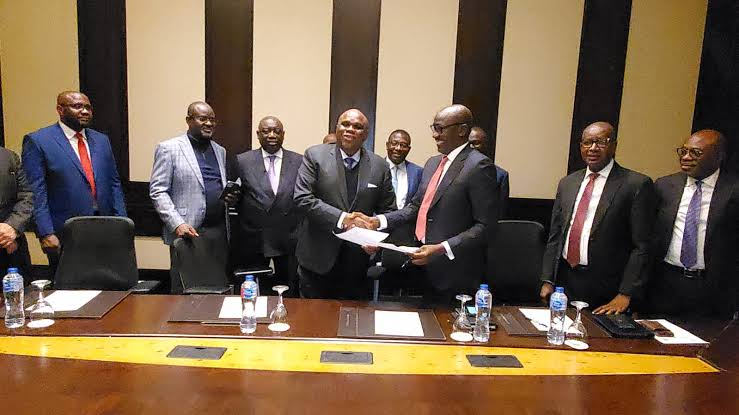

The Nigerian National Petroleum Company Limited (NNPCL) has explained the rationale for its intervention in the $3.3 billion crude oil pre-payment loan it signed with the African Export-Import Bank (Afreximbank) in 2023.

The NNPCL added that the loan is needed as a mid-term solution to the foreign exchange challenges being experienced in the country.

According to Persecondnews, in August 2023, NNPCL announced that it had secured a $3 billion emergency loan from Afreximbank to stabilize the country’s volatile foreign exchange market.

A year ago, the national oil firm said it had secured a $5 billion corporate finance commitment from the same Afreximbank to fund major investments in Nigeria’s upstream sector.

Also, in December 2023, the Bola Tinubu administration proactively announced the receipt of $2.25 billion of the $3.3 billion facility from the multilateral financial institution.

Afreximbank is the lead arranger of the loan, while some other sub-lenders included VITOL; Guvnor, one of the world’s largest energy trading houses by turnover; Sahara Energy Group; Oando; and the United Bank for Africa (UBA), which chipped in $100 million.

Speaking on the implication of the facility for Nigeria’s oil production, the NNPCL spokesman, Mr. Olufemi Soneye, said that the deal dubbed “Project Gazelle, which is the forward sale of oil, the first of its kind to be facilitated by any government institution in Nigeria was a necessary intervention aimed at providing dollar financing for the government of Nigeria to address the forex shortage.

NNPC Limited, which serves as the seller and sponsor, is the sponsor of the crude oil-backed forward-sale structured finance facility known as Project Gazelle.

The facility involves the forward sale of a specific number of barrels of crude oil to a Special Purpose Vehicle (SPV), which has approached international financial institutions for the required funding.

The proceeds from the forward sale will be available to NNPC Limited for use.

“NNPC Ltd. entered into this arrangement to ultimately provide dollar financing to the federal government. It is a short- to mid-term solution to the nation’s current foreign exchange shortage issue.

“Nigeria needs to urgently improve its foreign exchange position. As of June 2023, the Central Bank had over S$6 billion of unmet obligations—forward contracts with third-party institutions that were past their expiry dates.

“These unmet obligations have pressured the nation’s external reserves and resulted in a significant devaluation of the naira. The pre-financing arrangement allows the federal government to receive foreign exchange in advance to enable it to resolve its unmet FX obligations.

”These inflows of foreign exchange will ensure exchange rate stability and are an immediate quick-win available to the country.

“Forward sale financing agreements for crude oil operate in the following way: An SPV (special purpose vehicle) enters into a forward sale agreement with the seller (in this case, NNPC Limited).

”The SPV then obtains financing from a bank or financial institution based on the agreed forward sale value of crude oil from NNPC Limited. This financing is often collateralized by the future price of crude oil itself.

“NNPC Limited (the Seller) can then use the proceeds from the forward sale to finance its operations, including operational expenses, production costs, investments in new projects, and prepayment of taxes and royalties.

”The SPV can use the proceeds from the sale of the crude oil to meet its financing obligations with the banks and financing institutions and return any excess from the final sales back to the original seller (NNPC Limited),’’ said Soneye in the interactive session with journalists in Abuja.

He explained that the funding available is used as investments in existing and prospective resources, adding that this could result in more oil and gas production in the country as new projects come on stream and higher oil and gas exports, bringing in more dollars and foreign currencies.

He also pointed out that international banks have a track record of providing forward-sale financings, which brings new Foreign (FDIs) into the country.

With Nigeria having over 35 billion barrels of proven reserves that need to be exploited and produced, Soneye said a fraction of these prospective reserves could be used to raise the required funding.

With forward sale financing, he noted that the country could securitize these proven oil reserves today, saying this improves foreign currency inflows immediately rather than having to wait for years.

“Also, by supporting more exports and bringing in overseas financing, forward-sale financing can significantly boost the availability of foreign currency for an oil- or gas-dependent country. This improves the country’s ability to pay for imports and manage its overall economy.

“When exports finally start, the forward-sale investments are repaid using the money earned from those same exports. This improves the country’s balance of payments.

“The financing gives the government more stable and predictable oil earnings. This helps in planning budgets and managing foreign exchange reserves,” Soneye also said.

On repayment of the Project Gazelle, he said up to 90,000 barrels had been earmarked for the purpose, adding that the quantity of crude earmarked is sized to ensure that there is sufficient cash available for the repayment of the facility as and when due and ensure that the borrower can also meet the other cashflow obligations, taking into consideration the expected future price of crude oil globally.

On how to improve Nigeria’s foreign exchange inflow with the NNPCL intervention, the spokesman said: “By using the upfront funding, Nigeria can maintain the stability of its currency, the Naira, and increase its foreign exchange reserves. Although increasing oil production and exports is another option, forward-sale contracts, like the one in NNPC Limited’s Project Gazelle, provide a quicker fix due to current investment restrictions.

“Forward-sale contracts enable resource-producing companies like NNPC Limited to receive significant upfront funding for new projects before production and export.

“The funding can then be used for investments in existing and future resources, leading to increased oil and gas production and higher exports, resulting in more dollars and foreign currencies entering the country. International banks have a history of providing forward-sale financing, which can bring new foreign direct investments (FDIs) into Nigeria.’’

On why the crude price under the arrangement is lower than the market price, Soneye explained:“The lower crude price in this arrangement is due to the conservative pricing strategy that accounts for the volatility of oil prices. This strategy helps reduce the risk of default and ensures financial stability. Oil prices are highly unpredictable, meaning prices can fluctuate up and down within any given period.

“Lenders prefer a low price for safety to ensure a limited risk of default. On the other hand, borrowers prefer a high price to minimize pledged volumes. The negotiated price sits in the middle and is usually a compromise between these two interests.’’