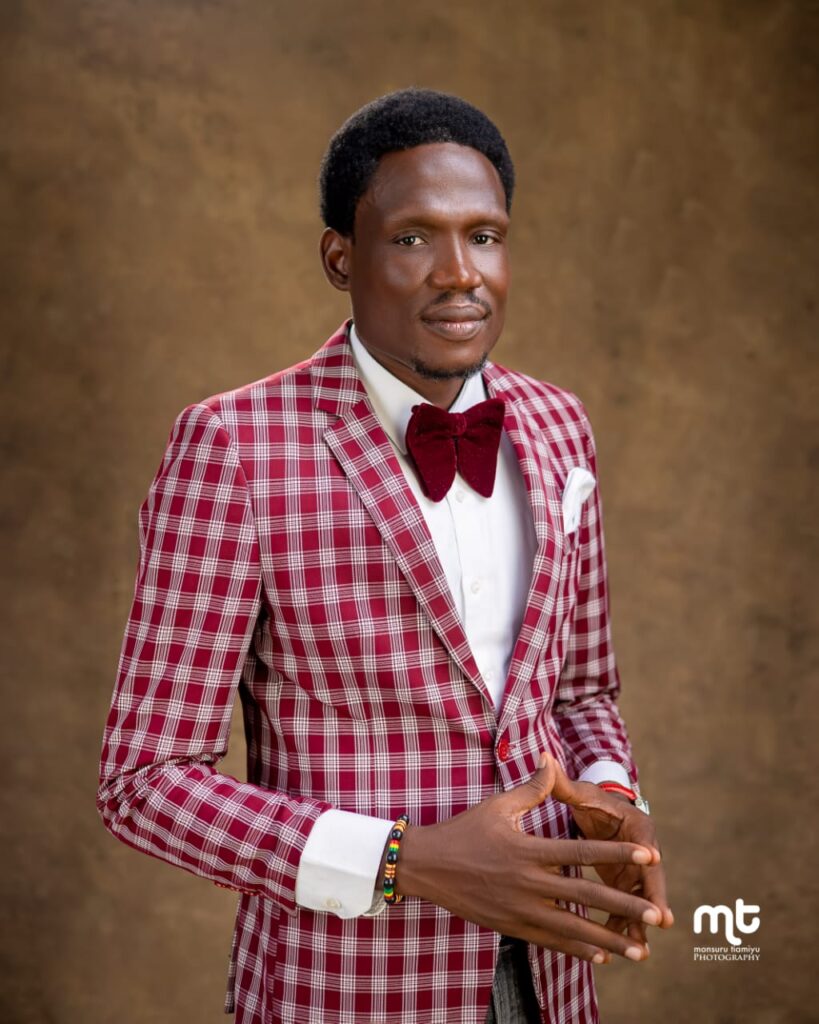

By Dr. Babatunde Raimi

THE EMOTIONAL AND PSYCHOLOGICAL IMPACT OF PENSION DELAYS IN NIGERIA BY DR. BABATUNDE RAIMI (08035063895 & 08178827380) IS NIGERIA’S NO. 1 PENSION AND RETIREMENT COACH AND ADVISOR, CEO, BABATUNDE RAIMI CONSULTING & BR & CO. LTD.

Emotional and Psychological Impact of Pension Delays: A Case Study of Nigerian Pensioners

In Nigeria, pension delays are a persistent issue affecting countless retirees. Certainly! Here’s a deeper dive into this subject matter. Also, it is my own way of identifying with these fine citizens who have given their all for their nation in exchange for a token of appreciation amongst others, which is often a mirage.

This case study explores the emotional and psychological toll on Nigerian pensioners, shedding light on their struggles and resilience.

Background on Nigeria’s Pension System

Historical Context: Overview of the evolution of Nigeria’s pension system, including the transition from the Defined Benefit Scheme (DBS) to the Contributory Pension Scheme (CPS).

Current Challenges: Examination of administrative inefficiencies, corruption, and economic instability contributing to pension delays.

Stress and Anxiety

Financial Insecurity: Many Nigerian pensioners rely entirely on their pensions for sustenance. Delays create severe financial insecurity. Where those who retired cannot access their pension on time, this leads to heightened stress and anxiety, as is currently being witnessed today.

Healthcare Concerns: Inability to afford necessary medical treatments and medications exacerbates health issues and adds to the psychological burden. The cost of drugs also have skyrocketed due to inflation and some major pharmaceutical companies leaving Nigeria. How will Retirees cope?

Daily Survival: The constant uncertainty of whether pensions will arrive forces retirees into a state of perpetual worry about meeting basic needs. Many of these Retirees have no other source of income or livelihood, so not getting their pension benefits on time is a big problem for them as they pray for quick intervention by all stakeholders.

Feelings of Neglect and Injustice

Betrayal by the State: Many pensioners feel abandoned by the government, experiencing a deep sense of betrayal after years of service because their pension and retirement benefits is not a privilege but a right.

Loss of Dignity: The struggle to make ends meet and the necessity to depend on others erode personal dignity and self-worth. As a nation, how can we subject our Senior Citizens to this lowly life of uncertainty and shame?

Public Outcry: Regular protests and public demonstrations by pensioners highlight their feelings of injustice and demand for timely pension payments.

Coping Mechanisms and Mental Health Support

Community Solidarity: Pensioners often form support groups to share their experiences and offer mutual aid, helping to alleviate some of the emotional burdens.

Religious Faith*: For many, faith and religious communities provide crucial emotional support and a sense of hope amidst uncertainty.

Professional Help*: Access to mental health services is limited, but those who can access counseling and therapy find it beneficial in managing stress and anxiety.

Social Isolation and Loneliness

Reduced Social Activities: Financial constraints force many pensioners to withdraw from social activities, leading to isolation.

Relying on Family: While family support is often available, the feeling of being a burden can lead to social withdrawal and loneliness.

Community Engagement: Efforts to engage pensioners in community activities can help combat loneliness and provide emotional support.

Impact on Family Relationships

Intergenerational Strain: Financial dependence on children or relatives can create tension and strain family relationships. In Nigeria today where the rate of unemployment and underemployment is high, even some children of some Retirees still depend of their aged parents for support.

Marital Stress: Financial stress often impacts marital relationships, causing conflicts and emotional distress.

Support Networks: Building strong family and community support networks is essential for emotional and psychological well-being.

Personal Narratives and Case Studies

Conclusion

Retirees who are yet to access their terminal benefits feel let down by the systems meant to protect them, leading to feelings of betrayal and neglect.

The emotional and psychological impact of pension delays on Nigerian pensioners is profound, affecting their mental health, family relationships, and overall well-being. Addressing these issues requires comprehensive reforms in Nigeria’s Contributory Pension Scheme (CPS), improved administrative efficiency, and stronger support networks for retirees.

Understanding the emotional and psychological impact of pension delays is crucial for addressing the needs of retirees comprehensively. By highlighting these effects, we can together as concerned citizens and stakeholders advocate for timely pension payments and provide better support systems to help retirees navigate these challenges.

This detailed examination not only sheds light on the emotional and psychological burdens of pension delays but also underscores the importance of comprehensive support and advocacy for timely pension disbursements.

Recommendations

Policy Reforms: Implementing stricter oversight and accountability measures to ensure timely pension disbursements.

Mental Health Services: Increasing access to mental health services tailored for retirees.

Community Support: Encouraging community programs and initiatives to provide emotional and social support for pensioners.

Advocacy and Awareness: Raising awareness about the plight of pensioners and advocating for their rights and well-being.

By exploring the emotional and psychological impacts of pension delays through the lens of Nigerian pensioners, this case study highlights the urgent need for systemic change and compassionate support for retirees.

Dr. Babatunde Raimi has vast local and international experience facilitating seminars bothering on Work Life Balance, Pension and retirement sensitization seminars across ministries, departments, agencies, para-military and private organisations. He has also granted several television, radio and newspaper interviews, advocating for a better life for all and sundry, especially for Senior Citizens. With his innovative and compassionate approach and deep understanding of the intricacies of pension systems in Nigeria, Dr. Babatunde Raimi interfaces with several retirees across board and counsels them regularly on the need to avoid retirment pitfalls, so as to embrace retirement without regrets.

Public Speaker and Author**: Dr. Babatunde Raimi is a sought-after speaker at international conferences and seminars, where he shares her insights on pension reforms, financial security, and retirement planning. He is also the author of several acclaimed books and articles on pensions and retirement. Some of his books includes, Planning Your Retirement, Beyond Salary & The Beauty Of Tragedy. His expertise is complemented by his extensive knowledge of finanancial planning and pension management, making him a formidable force in the industry.

Education:

- Bachelor of Science (B.Sc. Ed), University of Lagos

- Master of Business Administration (MBA), University of Lagos.

- Master of Public and International Affairs (MPIA – in view), University of Lagos.

- Student Member (Intermediate 2), Chartered Institute of Personel Management, CIPM.

Publications*:

- Author of the best-selling book “Planning Your Retirement

- Beyond Salary

- The Beauty of Tragedy

- Love Leads (A Collection of 100 love poems)

Awards:

- Recipient of the prestigious Africa Illustrious Awards, 2023.

- Distinguished Fellow, Institute of Leadership, Manpower & Management Decelopment, Doctorate (Honoris Causa)

- Merit Award, Association of Resident Doctors, Lagos University Teachjng Hospital.

- Special Recognition Awards, House of Talents

Dr. Babatunde’s exceptional contributions to his nation in his area of calling have earned him numerous accolades and recognition from reputable organizations and institutions. You should recommend him to your MDA or organisation for a comprehensive pension and retirement sensitization seminar and you will.not regret it.

For bookings and enquiries, you can reach him directly on his mobile: 08035063895 & 08178827380

Dr. Babatunde Raimi

08035063895 & 08178827380